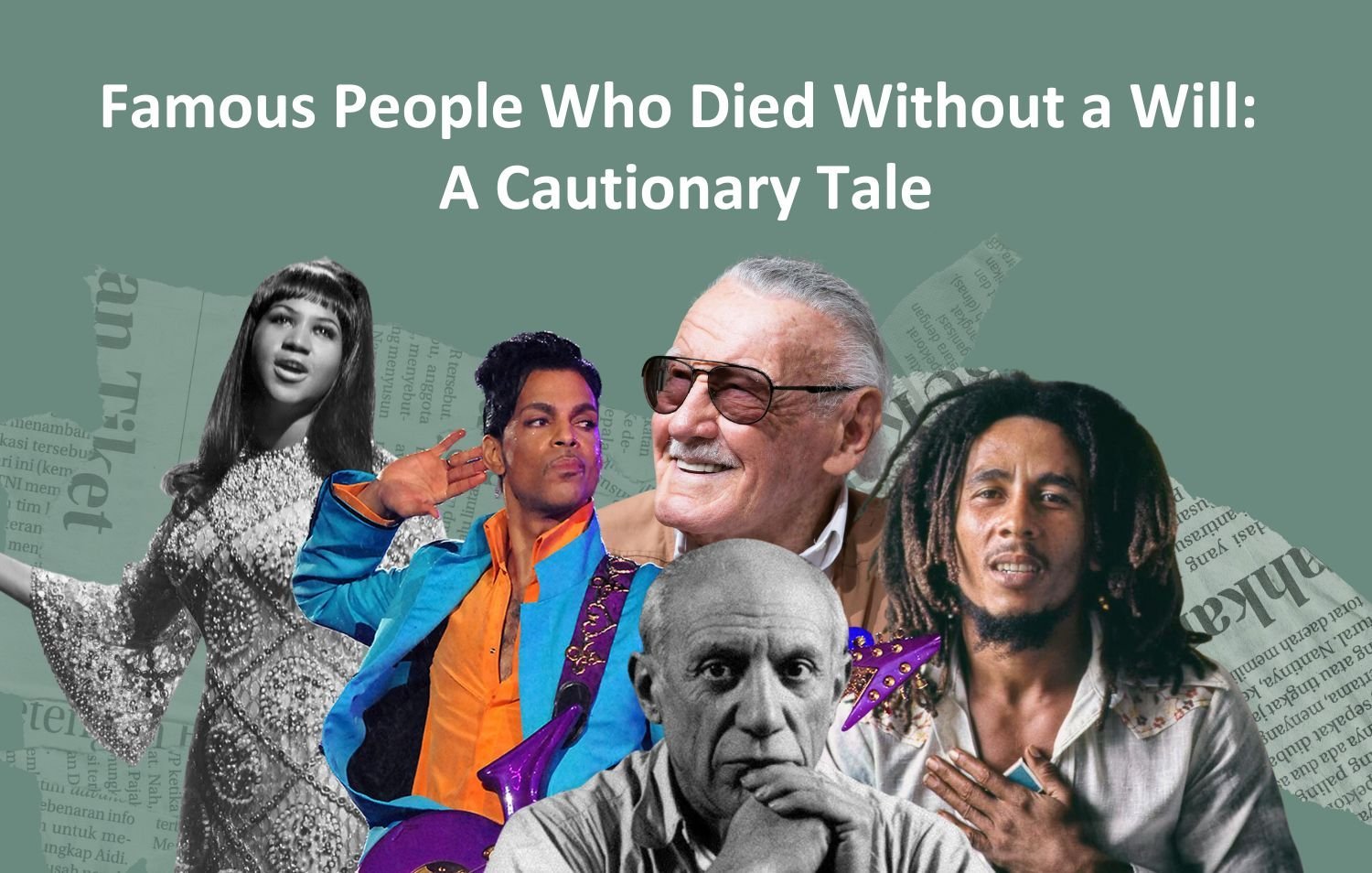

COULD YOU BE LEAVING THE SAME LEGACY AS THESE CELEBRITIES?

Would you want this to occur to you? The legal battles over most of these celebrity’s estate will go on for years. An unintended myriad of problems and traditions left behind about their life living and beyond the grave.

A will does not prevent probate. A will does not eliminate the estate tax. If you die with a will or without a will your personal and genuine home has to go to probate. If you have residential or commercial property in more than one state, each states’ probate court has jurisdiction to probate the will.

What’s probate? Probate is a public procedure where a local court of jurisdiction (probate court) assumes the responsibility of determining who gets what. The court will determine the legitimacy of your will?

The court of probate will take inventory of your real and individual property. In addition, the probate court will appoint and investigate claims made against your home from possible and real creditors and even designate accountants and legal representatives to drag the procedure.

SO WHY HAVE A WILL? WHAT GOOD IS A WILL?

There are 2 legitimate reasons for having a will. The will enables:

( 1) The assignment of a custodial guardian of small children.

( 2) The assignment of an executor.

The task of picking a guardian for your small children is the most important aspect of having a will. Pick your custodian well, based upon the love of your kids as if you were going to be there. Traditionally, you would pass by the administrator of your will to be the guardian of your small kids.

All other elements of the will can be highly objected to by anybody having an interest in the outcome of any distributions. Even a very well prepared will becomes a public file and must go to probate in each state where the decedent had property.

If you’re interested, Anna Nicole’s will is a public document; even you can get a copy. Final disposition and fight over her estate is going to play before our eyes for several years to come. Is this what you would desire?

THINGS YOU CAN DO TO AVOID LOSING CONTROL OF YOUR ASSETS

What can you do to avoid the kind of media circus over your assets? Can you prevent leaving this agonizing tradition? A definite and outright YES.

Aside from the custody of minor kids, a will does not supply any type of safety net over your possessions. Only a Trust will prevent this public disclosure of what needs to be a personal matter in between you and the properties you leave behind.

A Trust is a Contract. If you choose to be private about your personal matter, a Trust, any Trust, will prevent probate; revocable or irrevocable, grantor or non-grantor type Trusts will avoid the probate procedure. A Trust is not just for the rich. Anyone with $200,000 or more must have a Trust.

An ideal Trust for under $500,000 is a living Trust, or a revocable Trust to prevent the probate procedure. Anyone with significant assets must have an Irrevocable Trust. While any Trust will prevent the probate procedure, only an Irrevocable Trust will prevent the probate process and avoid the estate tax or the estate tax.

WHAT’S THE DISTINCTION BETWEEN REVOCABLE AND IRREVOCABLE TRUSTS?

With a Revocable Trust the word “revocable” implies that you have sufficient strings to withdraw the agreement; nullify and void it. While it will prevent going to probate and drag your unclean linen through the public procedure, it will not prevent the inheritance/estate tax, since on the date of your death you still owned your properties in your name.

For purposes of tax and civil liability the “revocable” strings connected, suggests that you did not quit power to manage and “own” on a long-lasting basis your assets; for that reason, you are the “considered” owner of the possessions. The Estate Tax is based on what you own in your name at the date of your death. So, the Probate Process is about who gets what; the Estate Tax has to do with who owns what and what’s it worth for the purpose of taxation.

The estate tax is based on the “reasonable cash worth” of your home of individual estate or property at the time of your death not at the time you purchased it. Items that are included in your estate are cash, CD’s, realty, investment accounts, IRA’s, getaways, art, jewelry, antiques, boats, airplanes, or anything of worth that could be transformed to money or near money. Only an Irrevocable Trust prevents both the Probate Process and the Estate/Inheritance Tax.

THE IRREVOCABLE TRUST

An Irrevocable Trust is a Contract whereby you quit “any ownership claims” versus your assets repositioned/transferred from you to your Irrevocable Trust. The secret to dissolving your ownership claims is with an Independent Trustee.

The Trustee can not be you or anyone related to you by blood or marriage. I do not suggest it because it could trigger disharmony of your family unit. Death changes people; money changes individuals.

If you have residential or commercial property in more than one state, each state’s probate court has jurisdiction to probate the will.

Probate is a public process whereby a regional court of jurisdiction (probate court) presumes the obligation of identifying who gets what. If you select to be personal about your private matter, a Trust, any Trust, will prevent probate; irreversible or revocable, grantor or non-grantor type Trusts will avoid the probate procedure. A best Trust for under $500,000 is a Living Trust, or a revocable Trust to avoid the probate process. While any Trust will avoid the probate process, only an Irrevocable Trust will prevent the probate procedure and prevent the inheritance tax or the estate tax.

Please take advantage of a free informational live webinar or a 1 on 1 private consultation (via Zoom call) that I have arranged for my readers with our preferred Estate Planning professionals. Click here to learn more about how you can get a Living Trust for your family and register for the zoom call (information only). Use referral code Kevin Byrd Stockton Mobile Notary and receive a free gift with your plan ($200. value)

(I may receive a commission for any purchase you make with Premier Estate Planning).